Digital Drives Efficiencies, Datacultr Drives Digital

Global Risk Management

and Digital Debt Collection Operating System

for the New to Credit

25 Million+

Loans secured

US $7 Billion+

Loan value secured

Digital Drives Efficiencies, Datacultr Drives Digital

Datacultr is a SaaS platform focused on the new-to-credit segment. As traditional collection methods continue to decline in effectiveness and drive up costs, Datacultr enables lenders to serve all customer segments profitably.

This approach is relevant for both low- or no-score customers, who are caught in a vicious cycle: lacking data, credible documentation, and collateralizable assets. If any credible data were available, financial institutions might have already offered them relevant products. That’s where Datacultr’s device financing platform comes in, providing a viable alternative for lenders by using the borrower’s smartphone to help reduce perceived risk.

Additionally, in times of declining right-party contacts and increasing customer adoption of digital technology,

Datacultr is making this segment viable by:

- Bringing down costs

- Driving efficiencies in traditional collection processes

We at Datacultr Empathise Emphasise Educate

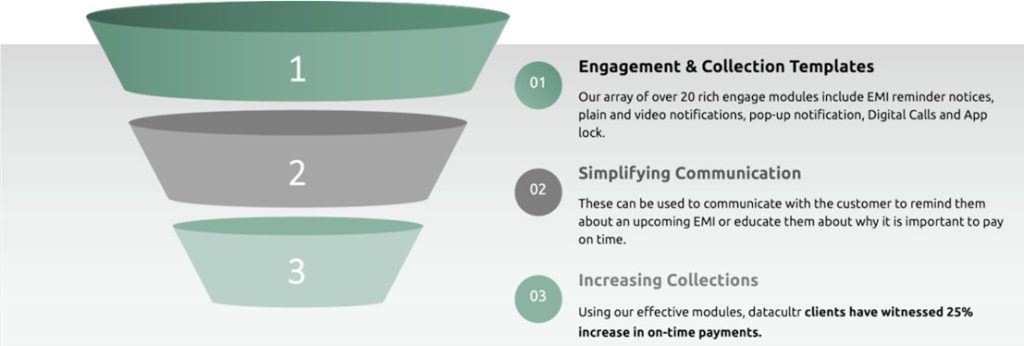

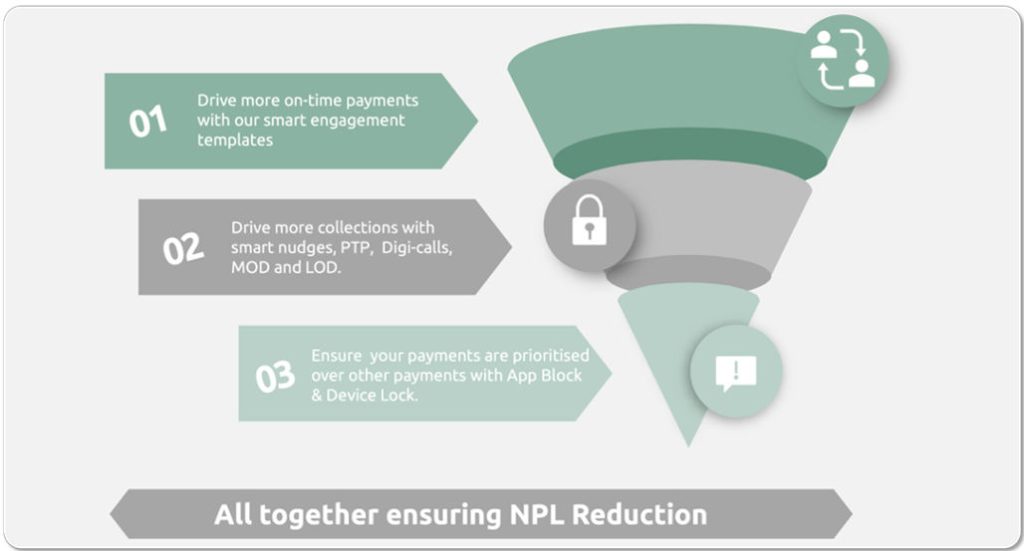

Mitigate Risk with Engagement and Device Lock Technology

Datacultr’s smart device locking technology empowers lenders to manage risk on financed smartphones.

When payments are missed, the device lock is activated, motivating borrowers to take action while still allowing access to essential functions. Combined with our engagement models and digitized collection processes, this prompts timely repayments, builds positive financial habits, and influences the borrower’s ‘intention to pay.’

Datacultr’s device lock solution works seamlessly across a wide range of devices and gives lenders the confidence to scale device financing without increasing risk exposure.

Transformational Impact

First Month Defaults

Non-Performing Loans

Debt Collection Efficiency

Loan Approvals

Drive Credit Decisioning with Device Financing Solutions

Financial institutions, telecom operators, retail chains, and fintech that provide smartphone financing, such as Buy Now Pay Later, microloans, nano loans, and other unsecured loans, use Datacultr’s innovative digital platform to increase loan approvals among customers in the 0 and -1 credit segments.

Smartphones are essential tools for livelihood and access. In the absence of alternative data, using the borrower’s smartphone as a virtual asset becomes a critical factor in lenders’ decision-making.

Automate the entire loan lifecycle.

GDPR compliant, ISO 27001-2013 & SOC2-Type 2 certified.

Digital formats that contact the device, not the mobile number.

Carried out at the retail store or by the customer.

Datacultr’s promise:

100% Contact-ability: Reach your customer even if they’ve changed their number.

100% Actionability: Send messages that prompt borrowers to take immediate action.

100% Deliverability: Delivery confirmation with a timestamp for every message.

100% Safety: Ensure every interaction is authenticated and secure. No spam, no unknown numbers.

100% Measurability: Track every interaction, engagement, and outcome to optimize performance and impact.

Welcome to the 100% Club

Datacultr’s promise:

100% Measurability

Track every interaction, engagement, and outcome to optimize performance and impact.

100% Contact-ability

Reach your customer even if they’ve changed their number.

100% Actionability

Send messages that prompt borrowers to take immediate action.

100% Deliverability

Delivery confirmation with a timestamp for every message.

100% Safety

Ensure every interaction is authenticated and secure. No spam, no unknown numbers.

How Datacultr Works

From first‑touch to full recovery, every financed device becomes smart collateral.

Onboard

First‑time borrowers learn their repayment responsibilities through in‑app guidance modules, right from the start.

Communicate

Keep the engagement positive yet persistent via direct device notifications so no payment date goes unseen.

Monitor

Real‑time behavioral analytics flag missed or late payments, suspicious location changes, or fraud patterns.

Recover & Reinforce

Once repayments are complete, devices regain full functionality. Persistent delinquencies trigger device lock.

Unlock Seamless Solutions with Datacultr: Your All-In-One Platform

Secure, device-driven solutions to empower financial inclusion and expand access for “new to credit”.

API-Driven for Efficient Lifecycle Automation

Automate the entire loan lifecycle with flexible APIs.

Embedded Payments for Seamless Transactions

Pay via apps, wallets, web, and USSD.

No Personally Identifiable Information Captured

GDPR compliant, ISO 27001-2013 & SOC2-Type 2 certified for data security.

Preview messages, manage users, and access chatbot support.

Multiple Layers of Security

With advance offline features